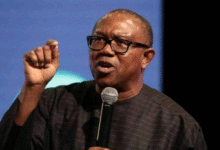

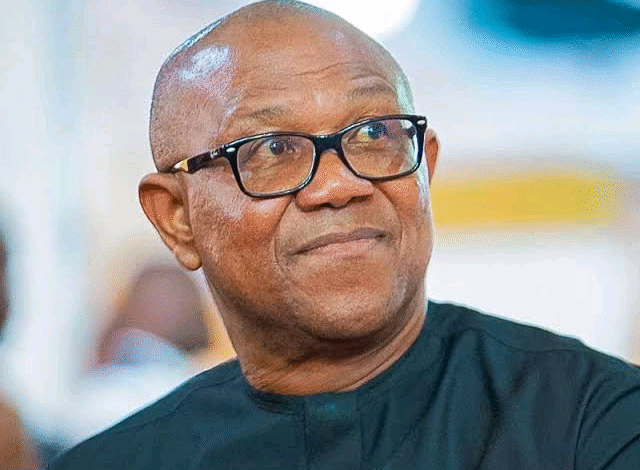

The 2023 presidential candidate of the Labour Party (LP), Mr. Peter Obi, has called on the Federal Government to publish the full details of the tax agreement between Nigeria and France.

This follows the FG’s recent signing of an agreement with France aimed at advancing the digital transformation of Nigeria’s tax administration. The development has sparked criticism from some notable Nigerians, including Obi.

Reacting to the development on Wednesday, Obi noted that international collaboration is not inherently objectionable. However, he asserted that agreements relating to tax administration, revenue systems, and data management require a high level of openness because of their direct impact on public trust.

“It is therefore worrisome that an agreement of this significance appears to have been concluded without the full terms being made public, and without a clear effort to explain its objectives, scope, and expected outcomes to Nigerians. Transparency is essential in matters that directly affect public revenue and institutional credibility.

“That said, I am not opposed to engaging foreign expertise. However, such engagements must be clearly justified, with a transparent explanation of the specific gaps they are intended to fill, why those gaps cannot be addressed locally, and, above all, the concrete benefits to Nigerians,” he stated.

According to him, this is important because Nigeria is not lacking in tax expertise. “The country has a strong pool of qualified tax professionals, advisory firms, and globally recognised consultancies already operating locally, with the capacity to support tax reform and modernisation.

“In light of this, it is reasonable for Nigerians to question why external partnerships are made a priority instead of strengthening and leveraging existing local capacity. Sustainable reform should build institutions from within.”

Obi lamented that these concerns arise at a time of significant economic strain, stressing that over 60 per cent of Nigerians live in multidimensional poverty.

“Youth unemployment remains widespread. Small and medium-scale enterprises are burdened by multiple taxes, while government borrowing continues to rise without commensurate gains in productivity. In such circumstances, policy attention should focus on simplifying the tax system, closing revenue leakages, broadening the tax base fairly, and ensuring prudent use of public resources,” he remarked.

The former Anambra State governor emphasised that any agreement or policy initiative that lacks transparency, public confidence, and clearly defined, measurable benefits risks further eroding trust in government.

“It is therefore imperative that the Federal Government publishes the full MoU, clearly explains its rationale, and outlines the mutual benefits – particularly the tangible advantages Nigeria stands to gain.”

He further stated that leadership demands openness, accountability, and commitment to the interests of the Nigerian people, adding that decisions of this nature must always be guided by what best serves the nation.