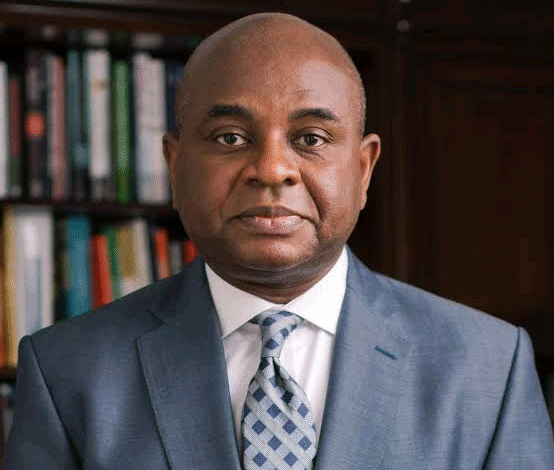

The President of the African School of Governance (ASG), Mr. Kingsley Moghalu, has identified debt as the major reason for underdevelopment in Africa.

In a post on X (formerly Twitter) on Monday, Moghalu stated that debt is blocking Africa’s development instead of facilitating it.

“African countries must borrow less, and spend more wisely and responsibly. How can African countries overcome the debt overhang? We must first understand why we borrow mindlessly and unwisely,” he said.

According to him, many African leaders lack a fundamental understanding of development in general and economic management in particular.

“They assume that once we can pay back our debts, what’s wrong with borrowing? The understanding that, especially with the ‘Africa risk premium’ in which the continent borrows internationally at much higher repayment rates (10–13% instead of 2-5% in other parts of the world), revenues may not always be able to match debt obligations, is lost on them.

“Reliant on commodity prices that often suffer shocks, many have found their assumptions overtaken by inconvenient reality. This is just like personal finance: if you borrow more than you can pay, the saying that ‘he that goes aborrowing goes assorowing’ comes into play,” he explained.

Moghalu also criticised what he described as the conceptual laziness of African leaders regarding debt to GDP ratios, noting that governments often take on more debt simply because the ratios appear low or manageable.

“Conventional economic wisdom says this ratio should not be more that 60-65%. Even worse, fiscal officials in African countries will cite the debt to GDP ratios of countries such as the United States (120%) and Japan (highest in the world at 240%) as ‘justification’ for their high borrowing.

“But they fail to understand the essential difference that these are fundamentally productive economies that create national and individual wealth through innovation, industrial productivity, and the efficient generation of capital internally. No African country is in this bracket. The structural basis of developed economies is very different from developing ones like ours.”

The former Deputy Governor of the Central Bank of Nigeria equally addressed the misconception surrounding borrowing for infrastructure development.

“Two essential understandings are missing here. The first is that infrastructure borrowed for should as much as possible generate revenues that help pay off the debt acquired. The second is that there are other, often better ways to fund infrastructure development such as Public-Private-Partnerships (PPPs) in which the risk and reward of infrastructure development is shared with private capital,” he stressed.

Moghalu also highlighted corruption as a major driver of Africa’s debt problem, asserting that accountability and transparency in the use of borrowed funds are weak in most African countries.

“Significant portions of borrowed funds simply disappear into private pockets of government officials,” he stated.

Similarly, pointed out political expediency, emphasising that many African politicians are addicted to what he described as “performative” politics, which they mistake for substantive governance.

“So, they want to ‘show workings’ with ‘projects’ which may have been funded with borrowed funds.”

He further outlined governance failure, arguing that many African leaders lack the capacity required to implement a holistic and effective approach to governance.

He added that fiscal and economic management, including budgeting, revenue generation, and debt management, is a core component of public sector governance.