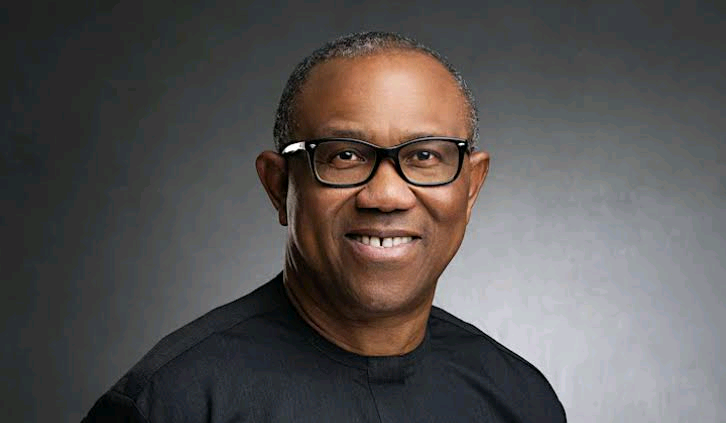

The 2023 presidential candidate of the Labour Party (LP), Mr. Peter Obi, has asserted that Nigeria must rethink its approach to taxation in order to achieve national unity and economic growth.

In a statement on Friday, Obi disclosed that travelling around the world and meeting leaders who have transformed their nations has made him understand that lasting economic and social progress begins with national consensus.

“Transformative leaders — those who successfully unite their people around a shared vision — share a defining quality: honesty. Government must be transparent and truthful because citizens deserve nothing less from those who lead them. True leaders do not exploit their people to enrich themselves and a few cronies; they build trust, unity, and shared purpose — the foundation of sustainable progress,” he stated.

Obi argued that Nigeria’s current approach to taxation must be carefully examined, stressing that if taxation is to function as a genuine social contract, it must be rooted in sincerity, fairness, and concern for the welfare of the people.

According to him, every tax policy should be clearly explained, including its impact on incomes and its expected contribution to national development. “Without this transparency, taxation becomes a tool of confusion and burden rather than a mechanism for growth and development.

“Nigeria must rethink taxation if it is serious about economic growth, national unity, and shared prosperity. The purpose of sound fiscal policy is not merely to raise revenue; it is to make the people wealthier so that the nation itself becomes stronger.”

He lamented that, instead, Nigerians are being asked to pay taxes without clarity, explanation, or visible benefit.

“The solution begins with empowering small and medium-sized enterprises in every community. When small businesses thrive, jobs are created, incomes rise, and the tax base expands naturally,” Obi explained. “You cannot tax your way out of poverty — you must produce your way out of it.”

He continued: “This makes the ongoing tax fraud saga particularly alarming. For the first time in Nigeria’s history, a tax law has reportedly been forged. The National Assembly itself has admitted that the version gazetted is not what was passed into law. Yet citizens are being asked to pay higher taxes under this manipulated framework — without transparency, without explanation, and without corresponding benefits.”

The former Anambra State governor also noted that there is no virtue in celebrating increased government revenue while the people grow poorer, emphasising that taxing poverty does not create wealth but instead deepens hardship.

He further said that any tax system that makes citizens poorer violates the fundamental principles of good governance and sound fiscal policy.

“Nigeria needs a fair, lawful, and people-centred tax system — one that supports production, rewards enterprise, protects the vulnerable, and restores trust between government and citizens. Only then can taxation become a true tool for unity, growth, and shared prosperity,” he added.