CrowdyVest Promised Big Returns But Turned around on Its Customers

By Joseph Olaoluwa

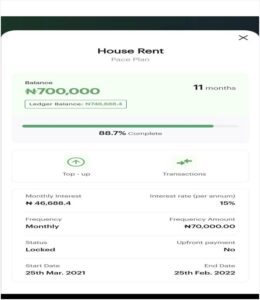

Phil Gboyega, a Lagos-based communications officer, first heard about Crowdyvest, a crowdfunding platform in 2021 while considering where to invest his year-end employment bonus. At the time, Crowdyvest promised 25% annual returns from backing Nigerian farmers. Gboyega invested ₦400,000.

In 2022, Crowdyvest did not pay the promised returns citing the fallout from the pandemic and defaults on the part of the farmers it back. “I have learnt never to save or patronize any investment platform in this life or the next,” said Gboyega, who is now one of 3,700 people whose funds remain unpaid by Crowdyvest.

Nearly three years after it stopped making payouts, the company has proposed converting its customers into shareholders to cover a ₦7.7 billion hole, while it works out a two-year plan to recover ₦2 billion from agriculture partners.

At least three customers said they are not confident about getting refunds. Their worries are not unfounded. The CrowdyVest app no longer works as the firm tries to raise new funding from new investors, a move that some of its disappointed customers believe is a red flag.

Agritech platforms, operating as a collective or directly as a marketplace to buy agro-related investment products, entered into the Nigerian market over the last decade as interest in the country’s startup ecosystem reached new highs. They promised retail investors attractive profits within months after their initial investments.

Their value proposition seemed compelling as they promised to radically improve the profitable but unorganised Nigerian agriculture value chain, while raking in healthy returns for their investors. But years later, several of these businesses have shut down on the weight of the industry’s inefficiencies and allegations of fraud by some executives.

CrowdyVest is one of the earliest and most high-profile agritech startups in Nigeria. The company was originally founded as Farmcrowdy in 2016 by Onyeka Akumah and Temitope Omotolani alongside three other co-founders years before Nigeria’s Securities and Exchange Commission (SEC) developed clear regulations for crowdfunding investments.

The company raised at least $2 million and by the end of 2021, it managed nearly ₦8 billion in investor assets which was worth nearly $20 million using the dollar exchange rate at the time.

In 2019, CrowdyVest was formed within Farmcrowdy — which itself rebranded as EMFATO Holdings, which owns other services including PlentyWaka, the Techstars-backed mobility service.

CrowdyVest closed its last funding round on March 11, 2022, with backing from the Africa Startup Initiative (ASI) in a non-equity Assistance round. It raised an undisclosed amount of funding in an undisclosed round per Crunchbase, with the ASI as its lead investor.

Since then, the company has since stagnated and defaulted on its payments to investors. Its founding CEO resigned from the company in March 2021, leaving his co-founder, Temitope Omotolani, in charge.

An ill-advised debt model

By 2021, EMFATO divested from CrowdyVest, handing over the reins of the platform to Omotolani who acquired the former Farmcrowdy’s obligations to customers and pivoted the service to a digital wealth management and savings platform.

According to the CrowdyVest CEO, its acquisition of EMFATO debt obligations to customers, in addition to a payment default from seven portfolio companies, plunged the nascent company into a financial quagmire. She declined to explain some of the key management decisions that went into the acquisition decision.

However, Omotolani explained that the debt repayment plan is on track and should be completed within the next two years. “We are concurrently exploring opportunities for our members to get a quarterly payout as we recover funds from project partners that are owing us and also give equity in the business,” she said in a written response to TechCabal’s questions.

Resolving the debt

The pathway to offsetting the debt still remains unclear, especially if the project partners default again on their promise. Also, the pathway to earning dividends from equity arrangement is also sketchy especially as the owed customers now have a stake in the business. This means that they could share in the losses of the founder after converting their funds to equity.

Part of those steps to regaining trust in the public was to get new board members and a committee of people who are also affected members, who have expertise in different areas that can help create oversight going forward. Some of these moves are similar to ones pulled by Thrive Agric when they found themselves in a similar situation. The sacrifice involved Uka Eje stepping down to the position of chief operating officer (COO) while allowing Adia Sowho to steer the ship as interim CEO. ThriveAgric navigated their perilous time with additional hands, fresh ideas, and the “bridge” capital (temporary financing) provided by Ventures Platform. This is a contrast to CrowdyVest who can only pay ₦2 billion while hoping to rest of owed funds to equity.

Raising a seed fund

With the decision to restart the business and set up a new fund, Omotolani told TechCabal in a statement that they now have to raise funds. “Crowdyvest has never raised equity funds before now, all the business growth and successes has been organic and self-funded. We hope to raise a seed fund to kickstart the new business. We are currently working on all required processes for the new business registration, structure, and partnerships, and we hope to launch by January 2024,” she wrote in the statement.

She said the firm is on course to announce new projects and products spanning across project financing, software-as-a-service, social commerce and some B2B partnership where they can make their earnings through commissions, subscriptions, profit-sharing, spreads, and so on. However to do that, they needed the confidence of the over 3,000 members being owed as they were the first priority moving forward.

To avoid a repeat of 2021, Omotolani said they have taken due diligence very seriously. “We are working with a Trustee, Investment committee, Fund-managers, Custodian, legal structures, and better risk assessment. We will explore other business opportunities that complement what we are already doing while being safety conscious as we progress,” she added.

For the CrowdyVest CEO, it has been a learning curve. “The past couple of months have been the toughest and daunting, yet we are not running away from the responsibilities, but we have continued to face things head on while looking for ways to resolve,” she wrote. “We have learnt so much on how to do things better which no business school can ever teach or prepare you for and we are certain of positive outcomes,” she added.